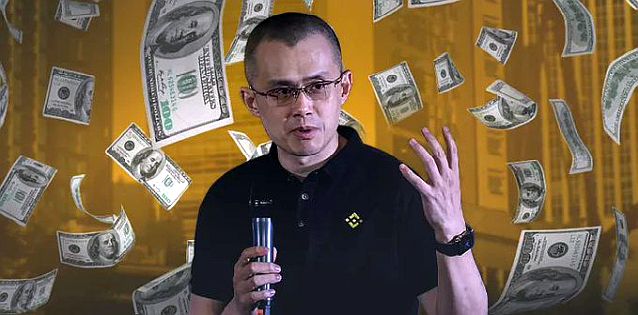

Changpeng Zhao, Binance’s former crypto CEO, sentenced to prison

(Changpeng Zhao is going to jail. Image credit: Twitter)

On April 30, Changpeng Zhao, the founder of Binance, the world’s largest cryptocurrency exchange, was sentenced to four months behind bars for allowing money laundering on the platform. At his sentencing hearing on Tuesday, U.S. District Judge Richard A. Jones commended Zhao for taking responsibility for his wrongdoing. Zhao pleaded guilty in November to one count of failing to maintain an anti-money-laundering program.

Binance also agreed to pay $4.3 billion to settle related allegations from the U.S. government. Zhao’s decision to ignore U.S. banking requirements that would have slowed the company’s explosive growth was troubling to the judge. Zhao is the first person ever sentenced to prison time for violations hao the Bank Secrecy Act (BSA).

Prosecutors argued that if he did not receive time in custody for the offense, no one would, rendering the law toothless, according to The Associated Press.

On November 21, 2023, Zhao, a Canadian national, pleaded guilty to failing to maintain an effective anti-money laundering (AML) program, in violation of the BSA . At that time, Zhao also resigned as CEO of Binance.

Binance launched in 2017 and focused on attracting high-volume customers, including U.S.-based customers. Binance quickly became the largest cryptocurrency exchange in the world, with the greatest share of its customers coming from the United States. As a result of serving U.S. customers, Binance was required to register with FinCEN as a money services business and to implement an effective AML program that was reasonably designed to prevent Binance from being used to facilitate money laundering.

Binance chose not to comply with U.S. law and failed to implement controls and procedures to prevent money laundering. Binance also did not implement controls that would have prevented U.S. customers from conducting transactions with customers in sanctioned jurisdictions, despite knowing that the system it used to match customers for transactions would necessarily cause transactions in violation of IEEPA.

Instead of complying with U.S. law, in 2019, Binance announced that it would block U.S. customers and launched a separate U.S. exchange, Binance.US. Despite this announcement, Binance took steps to maintain a substantial number of U.S. customers. In particular, Binance focused on retaining valuable “VIP” customers, which were responsible for a large portion of Binance’s trading volume and revenue. These VIP customers were critical to Binance’s business because they helped provide the necessary liquidity to facilitate trades of digital assets.

For example, Binance executives, including Zhao, made a plan to contact VIP customers and help the VIP register a new account for an offshore entity and transfer holdings to that account. Binance employees also called U.S. VIPs to encourage them to provide information that suggested the customer was not located in the United States.

As part of his plea agreement, Binance agreed to forfeit $2,510,650,588 and to pay a criminal fine of $1,805,475,575 for a total financial penalty of $4,316,126,163.

For more on Zhao’s sentencing, see the video accompanying this article.

–

(Changpeng Zhao, cover photo, Image credit: Twitter)

Posted by Richard Webster, Ace News Today

Follow Richard on Facebook, Twitter & Instagram